Make high-confidence decisions in the renewable fuels market

Equipping Energy Leaders with Precise Intelligence

Actionable Renewable Fuels Market Insights You Can Trust

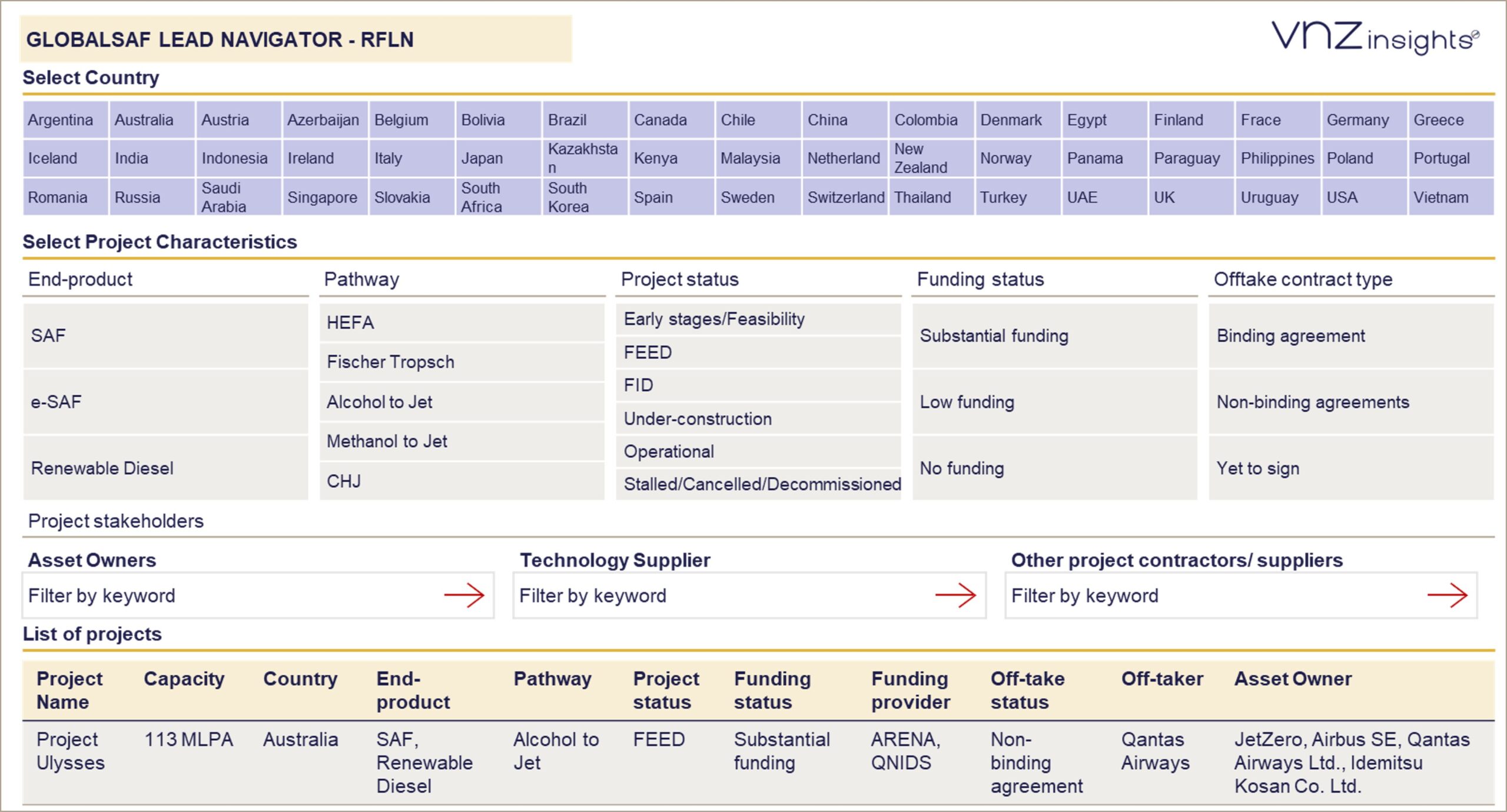

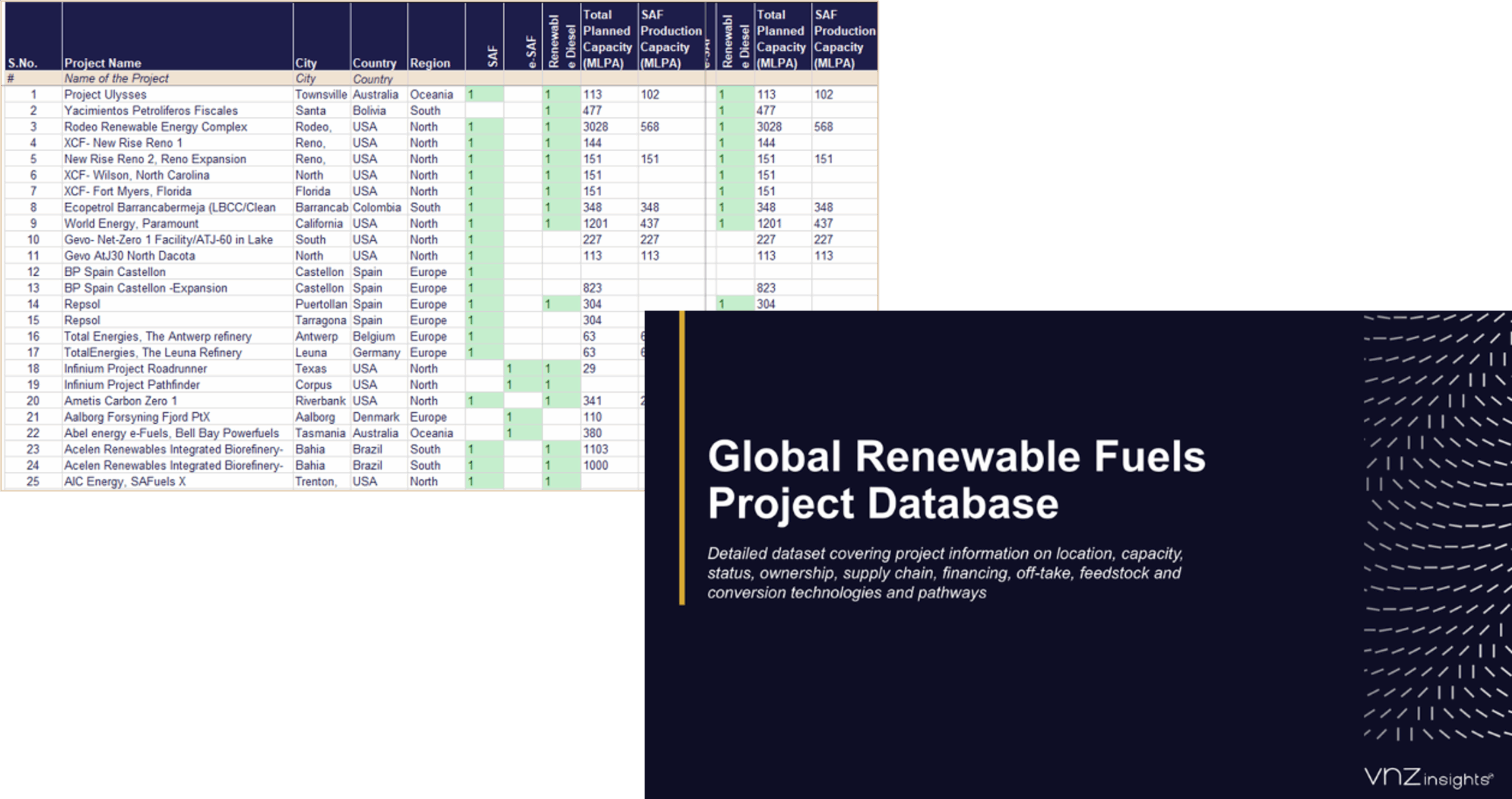

Live, searchable dashboards covering global SAF, renewable diesel, methanol, and green ammonia projects with maturity signals and filters.

Structured views of global policies, incentives, mandates, and auction schemes affecting SAF, renewable diesel, methanol, and green ammonia pathways.

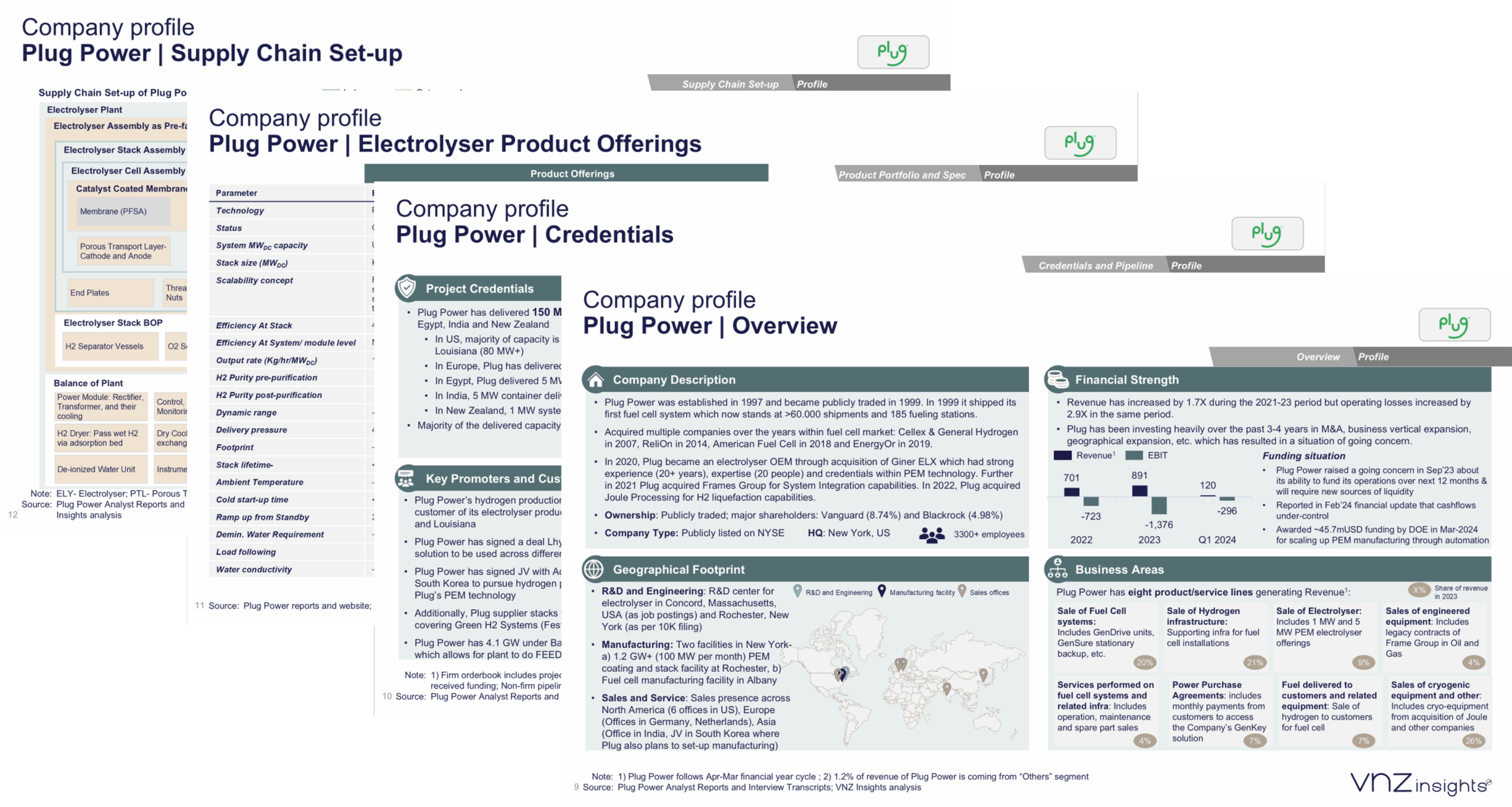

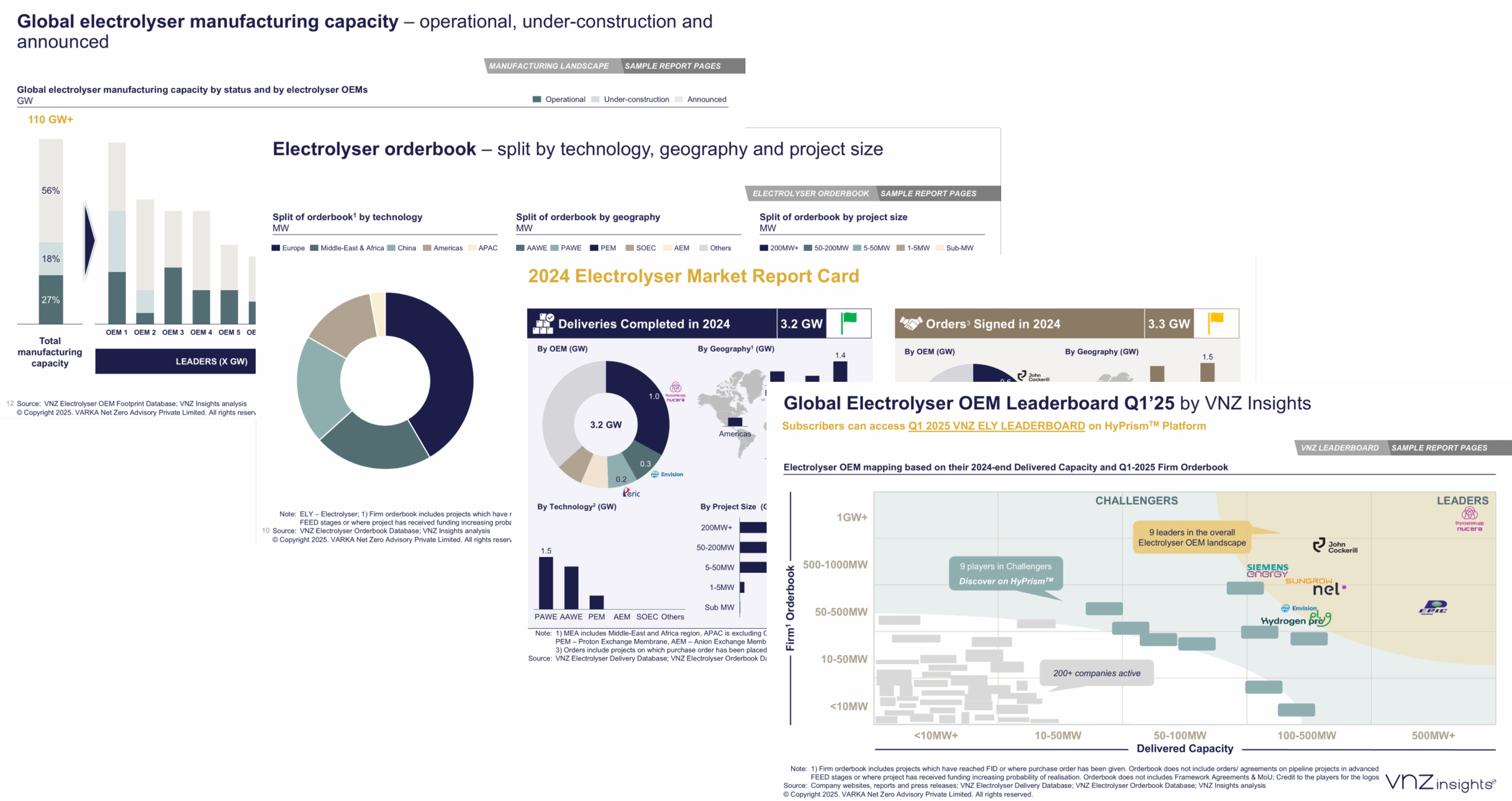

Deep profiles of Asset Developers, OEMs, EPCs, and supply-chain players mapped across technologies, roles, and commercial activity.

Market landscapes, policy trackers, and pathway deep-dives designed to support sales, strategy, and planning.

Structured spreadsheets of orderbook, offtake, operational capacities, OEM and supplier presence.

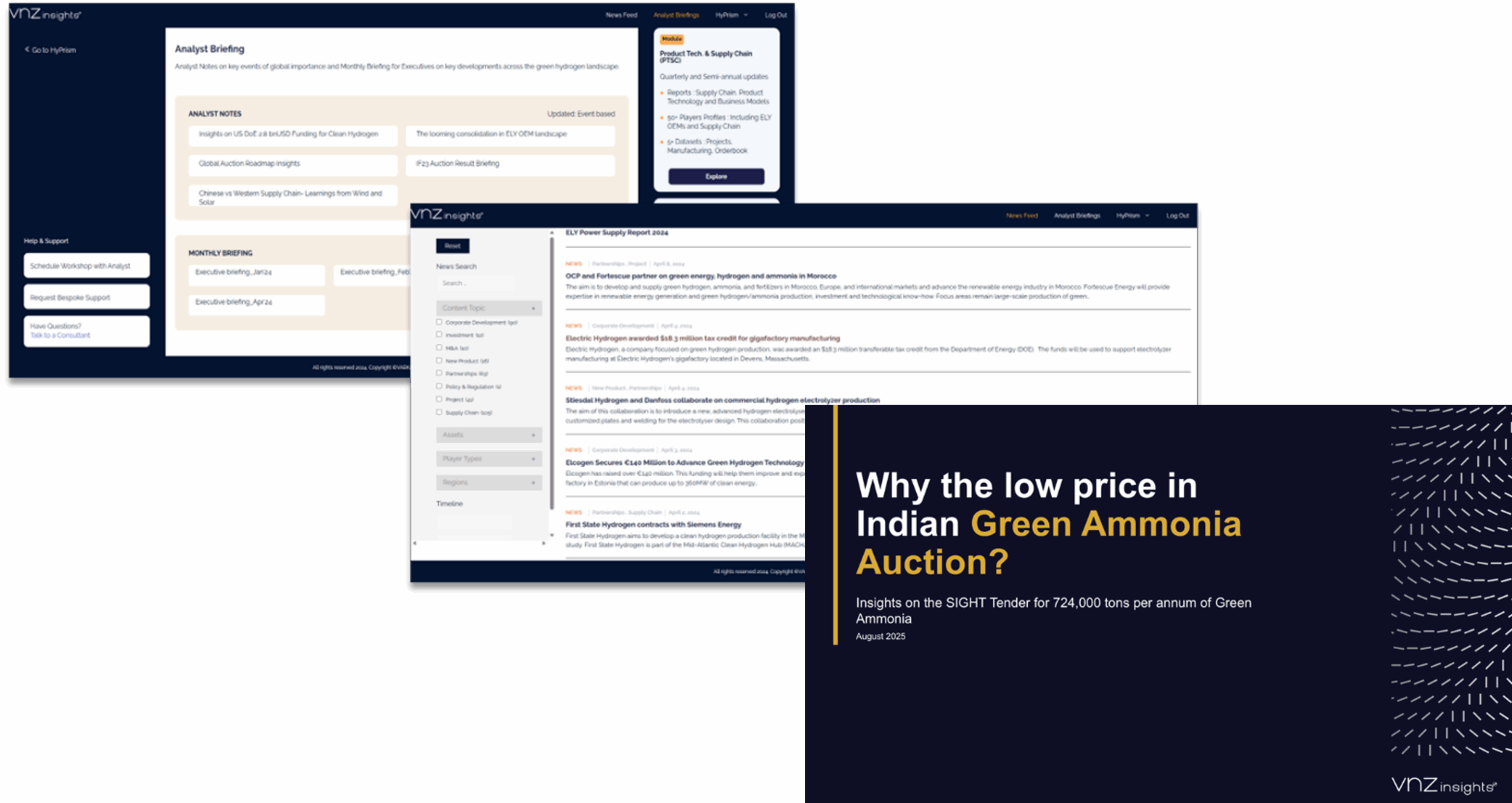

Verified and timely updates on project activity, funding, EPC wins, and offtake moves through detailed briefings.

Designed for Players across the Renewable Fuels Value Chain

Get started today with verified, in-depth market intelligence.

Book a DemoExplore our latest Renewable Fuels Insights

Frequently Asked Questions

RFLN is a decision-grade intelligence platform for SAF, eSAF, renewable diesel, methanol, and green ammonia. Unlike static reports or unverified databases, it provides verified project pipelines, developer maturity signals, technology pathways, funding and offtake visibility — enabling commercial, strategy, and BD teams to act on real opportunities rather than announcements.

RFLN serves users who need deep visibility into real project activity and commercial opportunity:

– OEMs (technology, catalysts, equipment)

– Asset developers and operators

– EPC and engineering firms

– Feedstock, logistics, and supply chain vendors

– Investors, advisory, and strategy teams

These teams rely on verified, high-credibility intelligence to drive sales, outreach, and strategic planning.

The maturity framework evaluates each project on multiple critical indicators:

- Funding signals — confirmed awards, grants, or financing progress

- Offtake agreements — binding or credible MOUs/contracts

- Developer track record — historical success delivering projects

- EPC/OEM appointments — evidence of commercial readiness

- Permitting and siting progress

- Technology pathway credibility

You can filter for projects that meet real commercial buying conditions: confirmed funding, secured offtake, FEED/FID stage progress, appointed EPC/OEM partners, technology pathway, capacity scale, and developer credibility. This ensures your pipeline is composed only of high-probability, sales-ready opportunities aligned to your strategy.

Yes. RFLN includes verified profiles of developers, asset owners, EPC partners, and supply chain participants. This enables you to map influence networks, prioritize repeat developers, track multi-project portfolios, and engage directly with the decision-makers who shape procurement, partnerships, and technology choices.

RFLN provides commercially relevant filters across:

– Technology pathways (SAF, eSAF, FT, HEFA, methanol, ammonia)

– Feedstock type and sourcing strategy

– Capacity and project scale

– Offtake visibility and customer type

– Funding and grant signals

– EPC/OEM participation

– Developer experience and portfolio size

– Permitting, siting, and timeline progress

These filters enable precise targeting across markets and project stages.

RFLN covers the full global renewable-fuels pipeline, including established, emerging, and early-stage markets. Data is refreshed monthly, while time-sensitive signals — funding rounds, FID decisions, EPC awards, offtake confirmations — are updated as soon as they are validated.

All project and company records are built through a strict verification process using:

– Primary research and developer interviews

– Regulatory and disclosure filings

– EPC/OEM supply chain confirmations

– Funding announcements and government records

– Technology-provider mapping

– Continuous analyst review

No scraping. No speculation. Only verified, structured, and decision-grade intelligence.

RFLN eliminates blindspots in project maturity, solves guesswork in pipeline qualification, reduces delays caused by fragmented or outdated information, and provides clarity on where real commercial activity is happening. It replaces slow internal research with fast, verified, decision-ready intelligence.

Teams gain a stronger, higher-quality sales pipeline, faster identification of procurement-ready projects, clear competitive visibility, improved win rates, reduced research time, and more accurate internal planning. RFLN becomes the intelligence layer for predictable, insight-led growth.

Yes. RFLN offers optional add-ons including competitive benchmarking, developer or OEM landscape mapping, country or pathway deep-dives, custom project shortlists, and policy or regional opportunity assessments — tailored to your strategy and markets.

You can request a customized walkthrough via the “Request a Demo” link or book time directly with our team. The demo is tailored to your segment and commercial or strategic goals.